Healthy ecosystems are essential for life on Earth, but they are declining at an alarming rate. Against this backdrop, governments and non-government organizations are scaling up restoration efforts, but there remain significant barriers. One of these is inadequate funding.

In the EU, the annual biodiversity finance gap is estimated at EUR 18.7 billion. While public finance remains the primary source of funding for restoration projects, private finance is playing an increasingly important role. However, there remains a lack of understanding and clarity on what projects are suitable for private finance, and how project developers can go about accessing it.

To answer some of these questions, UNEP-WCMC led an expert Finance for Restoration Taskforce under the Endangered Landscapes and Seascapes Programme’s Convening for Restoration project, which produced the ‘Restoration Project Developers’ Playbook on Private Finance (Europe)’. The Playbook is designed specifically for project developers, practitioners and NGOs unfamiliar with private finance options and processes. It provides clear, practical guidance, along with informative case studies from across Europe that will support project developers as they evaluate the ‘bankability’ of their restoration projects.

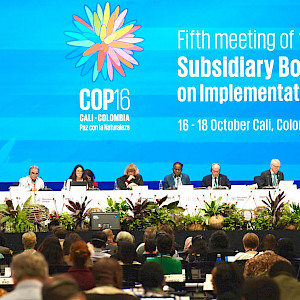

"In convening the Finance for Restoration Taskforce, we brought together a diverse range of experts in finance, policy and restoration. We also took part in international events and workshops. The insights from these discussions have guided the creation of The Playbook, and we hope it will help restoration practitioners overcome some of the barriers to accessing private finance" (Rodrigo Cassola, Principal Specialist, Nature and Finance, UNEP-WCMC and Convenor, ELSP Finance for Restoration Taskforce, Europe).

Understanding private sector motivation

When considering financing options for restoration projects, it’s important to recognize that private finance will not always be suitable. The Playbook sets out some of the most common motivations that drive businesses and financial institutions to support restoration projects. These range from complying with regulatory requirements to addressing reputational risks. The Playbook guides practitioners as they consider whether their own project aligns with these motivations.

Building on this context, The Playbook then sets out different types of private finance options and explains which of these may be suitable for different kinds of projects. For example, revenue-generating projects will be more attractive to funders offering commercial loans or seeking a return on investment. Non-revenue-generating projects, meanwhile, are best suited to corporate funding.

Providing practical guidance

Knowing which private finance options are out there is an important part of developing a restoration project, but it is only the start. Project developers must create a robust business plan tailored to the private finance source that they are interested in attracting. This can be a daunting hurdle to face, but The Playbook provides straightforward, practical advice on the main components of a business plan, alongside basic guidance on legal structures to consider when starting a new project. An overview of the impact monitoring and reporting frameworks and metrics that developers should be aware of is also included.

Case study: securing investment through regenerative agriculture

The citrus fruit producer Masía el Carmen, based in Valencia, Spain, is a leader in organic and regenerative agricultural practices. These range from installing beehives to implementing a ‘scorecard’ system to measure farms’ progress in key areas such as soil health and biodiversity. The producer is also a partner of the CrowdFarming platform, which enables farmers from all over the world to connect with consumers and sell their harvests directly to them.

It was thanks to this sustainable, socially minded ethos that Masía el Carmen was able to secure a loan of just under EUR 11 million from Triodos Bank for its regenerative agricultural activities. These activities fulfilled the bank’s criteria for transformative change. Also, importantly, Masía el Carmen had prepared a robust business plan that recognized and accounted for potential risks. For example, the plan included a strategy for crop diversification as a means of safeguarding agricultural activities in the region and boosting resilience in the face of climate risks such as drought and flooding.

This case study highlights how understanding private finance motivations is an essential part of attracting private sector finance for restoration projects.

"At Triodos Bank we are committed to supporting initiatives like Masía el Carmen’s that seek transformative change by managing nature as our ancestors did. In addition to regenerating ecosystems, they promote a new robust economy based on planetary boundaries" (Maria Cruz De Pablo Pecharromán, Director of Lending Strategy, Triodos Bank Spain).

Although private finance will not be feasible for every restoration project, The Playbook shows that there is a wide range of possibilities for engagement. The EU Nature Restoration Regulation aims to mobilize additional finance for restoration activities. As a result, there is an opportunity for restoration project developers to benefit from private finance options that will allow them to increase the scale and effectiveness of their work.

The Restoration Project Developers’ Playbook on Private Finance (Europe) can be downloaded here.